There is no denying that the global economic landscape is facing a very difficult period. The Bank of England (the “BoE”) and the US Federal Reserve have both recently raised interest rates, with the BoE announcing that the UK economy is already in a recession that is projected to last until the second quarter of 2024 – making this recession the longest since records began. (*1)

As borrowing continues to become more expensive, and companies are forced to make savings, unemployment will rise and the economy will continue to contract. This kind of downturn is inevitably an unfavourable ecosystem in which to do business. However, some of the best and most robust companies have been founded during these types of conditions, meaning that for a shrewd investor, this can be the perfect environment to look for opportunities.

The most important factor to weathering an economic storm is adaptability. Much like in natural selection, it is the companies whose survival traits work the best or who learn to outperform competitors that evolve. In winemaking, vintners often say that to produce a fantastic vintage, the vines have to suffer. Not too much or else you risk losing part of the crop, but if there is a frost or a burst of sustained heat during the growing period the vine is forced to adapt and this adds character to the grape.

This allegory can be applied to companies during the hardships of an economic downturn. The companies that adapt the fastest can gain a valuable leg up against competitors at a time when securing funding is most difficult. The start-ups that develop this robust character during difficult times, have a greater opportunity to build lasting and trusted networks of users in a sparsely populated landscape.

Companies that are conservative with their cash and that demonstrate clear paths to profitability will present themselves desirably to investors. Furthermore, as consumers look to save money, companies that offer competitive prices are likely to flourish in current market conditions. In the past, companies like AirBnB have capitalised on this search for value for money, and any startups that can offer customers savings are likely to do the same. Similarly during 2015’s “earnings recession” the British budget homeware retailer Wilkinson Hardware Stores was relaunched as Wilko and achieved great success.

Start-ups are also likely to benefit from a new pool of talent seeking employment in a turbulent market. As redundancies are made by companies looking to economise, new graduates entering the workforce will be turned away from corporate roles and look to find work amongst start -ups or else decide to start their own businesses. In fact, the Covid Pandemic actually saw a 30% year on year rise of new business registration in the UK. (*2)

Similarly, workers who have been made redundant turn to other professions to make ends meet, with P2P services like Deliveroo and Uber offering reliable work, and creating an untapped workforce for certain sectors.

Companies that offer mission-critical software often tend to thrive during a downturn. Past examples of this include SumUp, the UK unicorn founded in 2012 that provided an easy way for businesses of all sizes to accept card payments, undercutting many competitors at the same time. (*3) Another example is PPRO, the payment infrastructure provider. Reaching unicorn status in 2021, PPRO doubled its transaction volumes in Q4 of 2020, when much of the world was in the midst of COVID lockdown.

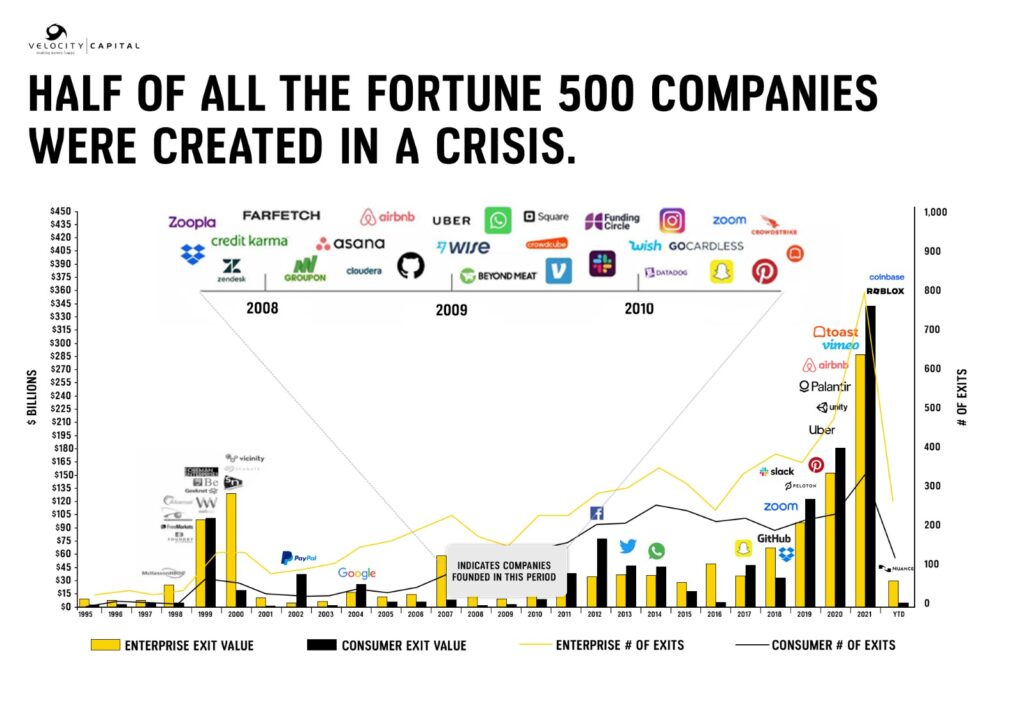

Ultimately, the downturn of today opens up the opportunities of tomorrow. Companies that can adapt fast, and provide the solutions needed by businesses and consumers to continue to function during turbulent market conditions are going to thrive. With more than half of Fortune 500 companies and many of the world’s unicorns having been founded during a period of economic instability, the proof is in the pudding.

The information in this article is the opinion of the writer and should not be taken as investment advice. Capital at risk.

(*1) https://www.bbc.co.uk/news/business-63471725

(*2) https://www.ft.com/content/3cbb0bcd-d7dc-47bb-97d8-e31fe80398fb

(*3) https://www.ft.com/content/5963a522-7356-3814-92a6-6a43f9dc5b62